The Enron Bankruptcy Case

Once the seventh largest company in the U.S., Enron gained the trust of investors and employees. The company rose through the ranks as an energy-producing company, also providing financial and risk management services, according to History. The unraveling of Enron’s illegal actions and subsequent bankruptcy filing left investors and employees with the realization that Enron wiped out their investments and jobs. Creditors lined up wondering what would happen next as details of the Enron collapse emerged.

The Unraveling Of Enron Debt

In November 2001, the announcement that Dynegy planned to purchase Enron for $9.5 billion quickly soured after  Enron restated earnings, revealing that the company lost $586 million. Dynegy withdrew its offers after “Standard & Poor’s cut its ratings on Enron bonds to “junk” status,” according to CNN Money. In the November 28, 2001 article, just prior to the Enron bankruptcy filing, CNN Money listed some of the companies affected by potential bankruptcy; including J.P. Morgan Chase with approximately $500 million unsecured debt and $400 million in loans and Duke Energy with approximately $100 million non-collateralized Enron debt.

Enron restated earnings, revealing that the company lost $586 million. Dynegy withdrew its offers after “Standard & Poor’s cut its ratings on Enron bonds to “junk” status,” according to CNN Money. In the November 28, 2001 article, just prior to the Enron bankruptcy filing, CNN Money listed some of the companies affected by potential bankruptcy; including J.P. Morgan Chase with approximately $500 million unsecured debt and $400 million in loans and Duke Energy with approximately $100 million non-collateralized Enron debt.

Even before the bankruptcy filing on December 2, 2001, employees got locked out of their own accounts, unable to sell their shares of Enron stocks. Although Enron employees were unable to save themselves, top executives at Enron sold off their shares, such as in the case of CEO Kenneth Lay, sold large amounts of his Enron stock, while also encouraging Enron employees to buy more shares and telling them that the company was on the rebound. As employees took Lay’s advice, prices plummeted even more, wiping out the entire investments, retirement accounts and life savings of thousands of employees. Lay and Jeffrey Skilling, former Enron Chief Executive, sold shares totaling $60 million, while, as MarketWatch reports, board members sold shares worth over $160 million.

Employees Led Astray

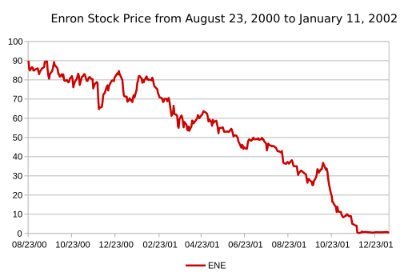

Robert Vigil, an electrical machinist foreman at Enron told MarketWatch said that employees trusted reports from upper-level management that the company showed strong financial growth and opportunity. Vigil said that employees lost an estimated $1 billion, when “Enron’s house of mirrors came crashing down.” Enron employees had millions of dollars in savings wiped out to and had to rely on food pantries just to have food to eat, after stock prices tumbled from $90 a share to less than 70 cents a share and the bankruptcy filing.

The Securities and Exchange Commission opened an investigation in October 2001, after Enron shocked employees and investors by announcing huge third quarter losses of $618 million. In January 2002, the U.S. Department of Justice opened a criminal investigation into the Enron collapse and, as documented in CNN Enron Fast Facts, the SEC widened its investigation to include Enron’s chief auditor, Arthur Andersen. Anderson ordered  the shredding of thousands of documents, resulting in a guilty plea on obstruction of justice charges.

the shredding of thousands of documents, resulting in a guilty plea on obstruction of justice charges.

Court Rulings & Verdicts

During the hearing before the House Energy and Commerce Committee, Andrew Fastow, Michael Kopper, Richard

Buy and Richard Causey invoked their Fifth Amendment rights, as did Richard Lay, when called to testify before the Senate Commerce Committee. Several employees either pleaded guilty to charges related to the Enron case or suffered the findings of guilt from the courts.

Lay died of a heart attack less than two months after his conviction on multiple counts of fraud and conspiracy. Skilling appealed and received a reduced sentence that took ten years off his original sentence.